Welcome to Lesson 0, where we will explore the best ways to use the 600+ money prompts designed to enhance your financial knowledge and guide you through personal finance strategies. By the end of this lesson, you’ll know how to effectively engage with ChatGPT to improve your financial management skills.

1. Getting Started with the Prompts

Each prompt is designed to tackle specific personal finance topics, such as budgeting, saving, debt management, and more. These prompts will act as a virtual coach, helping you navigate different areas of your financial life. Here’s how to get started:

•Open ChatGPT: Use ChatGPT on your preferred platform, whether on a web browser, mobile app, or desktop.

•Select the Prompt: Choose the prompt that aligns with the topic you want to explore. For example, if you’re focusing on building a budget, select the budgeting prompt from the collection.

2. Engage with the Prompts

Once you have chosen a prompt, paste it into the ChatGPT input box. For example, if you’re working on a savings plan, use a prompt like: “How can I establish a long-term savings plan?” ChatGPT will provide a detailed response, offering tips and actionable steps based on the prompt.

•Understand the Response: Take your time to read through ChatGPT’s response carefully. The goal is to absorb the advice and understand how it applies to your current financial situation.

3. Customize the Prompts for Your Needs

The power of ChatGPT lies in its flexibility. You can tailor the prompts to your unique circumstances. Here’s how:

•Add Personal Details: Include your specific financial data to get a more customized answer. For example, modify the prompt by adding, “I have $1,000 in monthly income and $300 in fixed expenses. How can I create a savings plan?”

•Follow-Up Questions: After ChatGPT provides its response, ask follow-up questions to dive deeper into areas you’re uncertain about. For example, “Can you explain more about high-yield savings accounts?” This interaction can help you clarify any doubts or gain more insights into specific topics.

4. Iterate for Better Results

Personal finance is an ongoing process, and so is your interaction with ChatGPT. It’s crucial to revisit prompts regularly as your financial situation evolves. If you’ve created a savings plan but want to optimize it further, return to ChatGPT for new ideas and strategies.

•Refine Your Approach: For example, after creating a budget, you may want to check in a month later to see if adjustments are needed. You can ask ChatGPT, “How can I improve my current budget to save more?”

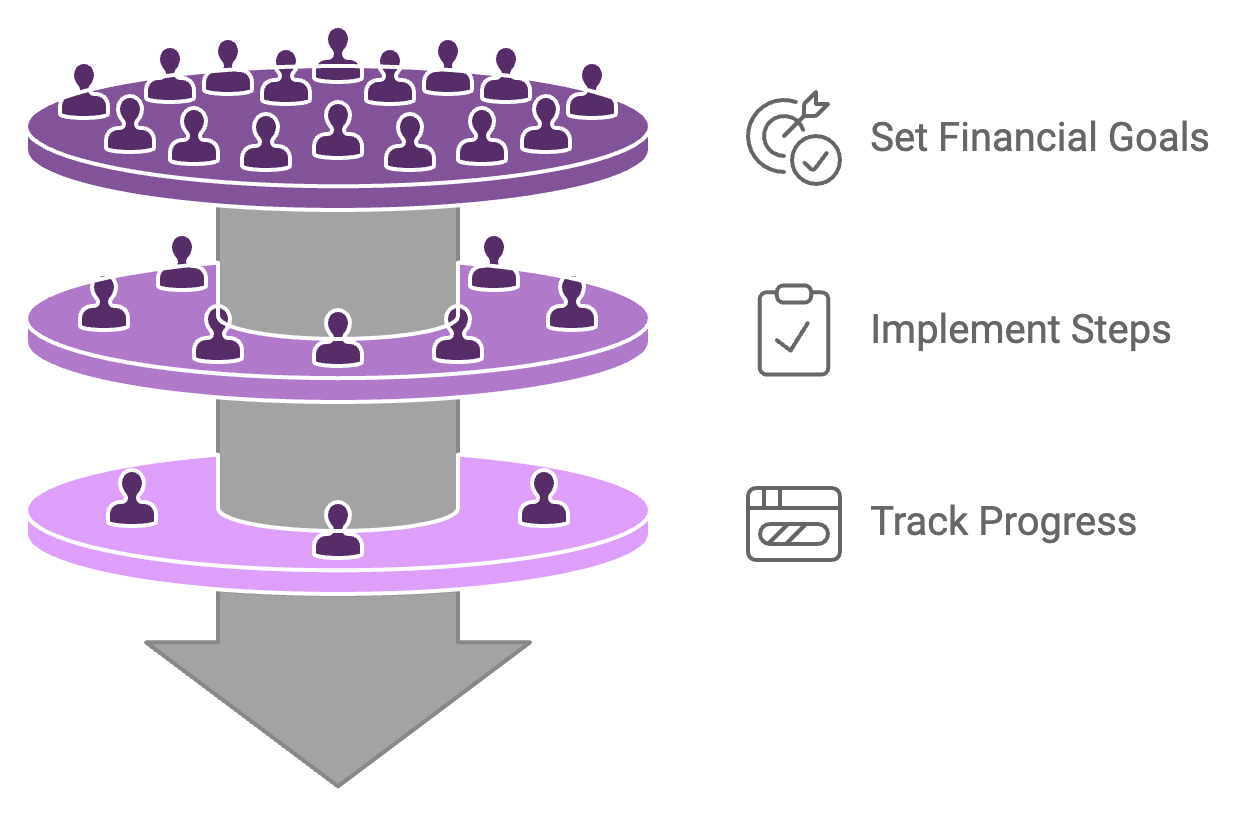

5. Apply What You Learn

While ChatGPT can provide you with excellent advice, the key to success is applying this knowledge. After receiving insights on a topic like debt management or budgeting, take action. Implement the steps suggested by ChatGPT in your daily financial routine.

•Set Financial Goals: Use prompts to help you set realistic financial goals. For example, ChatGPT can guide you on how to save for a down payment on a house or create an emergency fund.

•Track Your Progress: Ask ChatGPT to help you track your financial goals, such as “How can I monitor my progress toward paying off debt?”

6. Integrating ChatGPT into Your Financial Routine

The best way to make these prompts work for you is by incorporating them into your regular financial check-ins. Here are some ideas:

•Weekly Check-Ins: Set aside time each week to interact with ChatGPT and review your finances. Use the prompts to check on your budget, savings, and expenses.

•Financial Planning: Every month, use prompts that focus on long-term financial planning, such as “What should my investment strategy be for the next year?” or “How can I prepare for retirement?”

7. Benefits of Using ChatGPT for Personal Finance

By consistently using these prompts with ChatGPT, you’ll gain several benefits:

•Expert Guidance: Get reliable advice on complicated topics like taxes, investing, and debt management without the need for a financial advisor.

•Tailored Insights: With each prompt, you’ll receive responses based on your financial data, ensuring that the advice is personalized to your needs.

•Continuous Learning: You’ll keep learning new strategies to improve your financial well-being, helping you become more confident in managing your finances.

By understanding how to use these prompts effectively, you can turn ChatGPT into a powerful tool for managing your personal finances. The more you engage with the prompts, the more refined your financial strategies will become.